Virtual assistant finance can buy property foreclosure. You should use the new Va financing once more if you were foreclosed prior to towards the a house, this can include certain lender limitations.

Let us diving with the both parties of your own Virtual assistant financing into foreclosures thing, to order a foreclosed house with the Va loan and just what it ends up to utilize your Virtual assistant mortgage shortly after going right on through a beneficial foreclosure your self.

Training the brand new particulars of the Experts Items (VA) requirements in terms of to find a house inside property foreclosure was the same as to acquire a house that’s a consistent private merchant owned sale. The necessity of timelines is a thing to look at. It indicates you can’t buy a beneficial foreclosed domestic that is ended up selling throughout the legal measures for everyone dollars making use of the Va loan. The entire process of emailing a financial can be a little more challenging and take longer than simply conversing with a private seller.

The new flip edge of purchasing a good foreclosed house is living through foreclosure and you will seeking make use of Virtual assistant loan once again. It is energizing to know that even Experts in addition to their group try given value and you can encouraged to have fun with their benefits once more when they keeps sustained making it as a consequence of crisis. Reported by users, lives goes! The good reports is that with a little piece of training into wishing, labeled as seasoning symptoms and you can credit history drops, not only are you able to make use of positives again, you could flourish studying next big date around how-to buy, hold and you may put money into your following.

See just what You Qualify for

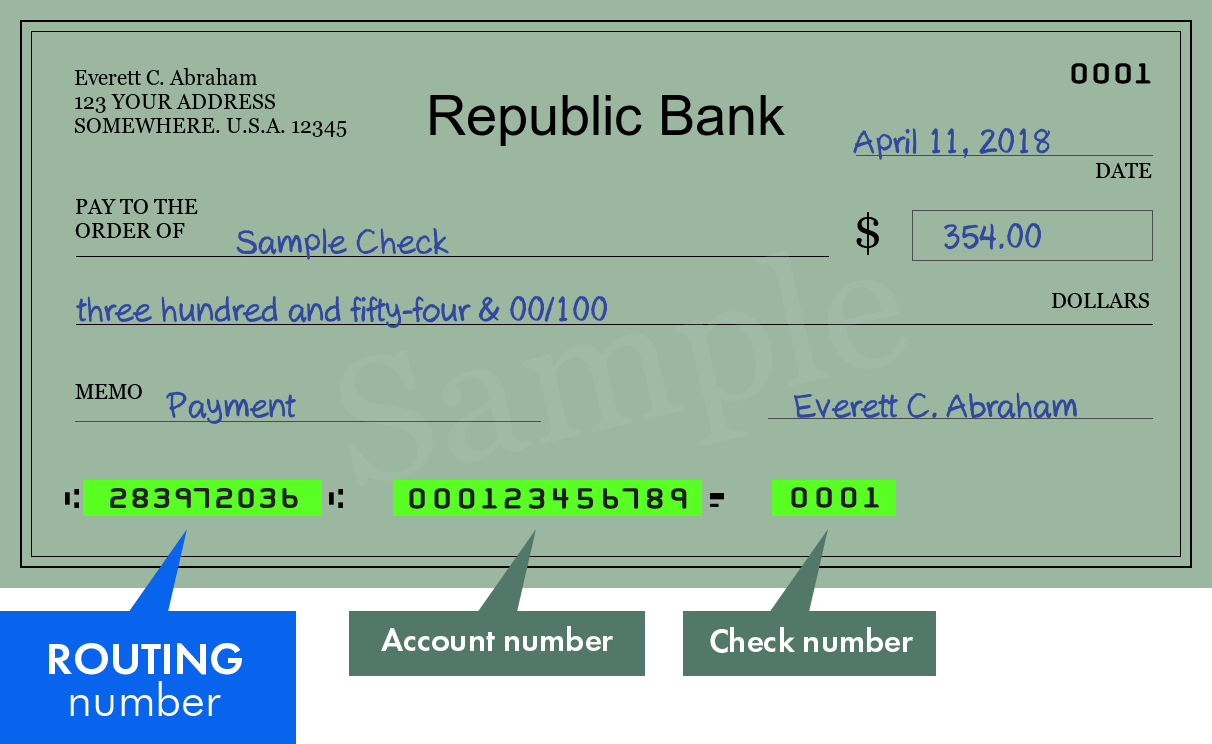

Playing with a credit card applicatoin process, lenders gives customers the finances having yet another home buy. Whenever obtaining an interest rate, things such as your credit rating will have into the total terms and conditions of your mortgage. In order to use an excellent Virtual assistant mortgage, the consumer need first meet with the qualification established by the Virtual assistant. Because visitors is approved to utilize the Virtual assistant mortgage, an experienced lender who’s accustomed the fresh new Virtual assistant mortgage often listed below are some their credit score or other activities. This is basically the certification process towards the consumer. The next step is to begin with hunting whenever you are getting mindful of the budget and acquire one to best house. The borrowed funds number have a tendency to push this new monthly mortgage repayments, as this is all part of the certification procedure.

Yes, you can purchase good foreclosed property that have a good Va financing! These mortgage is a regular Va financing. The settlement costs will be the identical to to find a non-foreclosed property. The new Va mortgage to own an excellent foreclosed assets get a few of an equivalent certificates you have in virtually any private business. Our installment loan Michigan house do not have any significant faults which can be structural and you will would make they disqualified with the Va financing requirements. Brand new Va financing normally beats the conventional home loan with regards to so you can staying money in to your wallet since you may finance the fresh entire loan amount. For the an effective foreclosed family, which is instance a benefit while the demon is within the information while looking along side house being structurally voice, plus the Va appraiser is going to remember to was entering good habitable household!

Virtual assistant Rules Complicate Foreclosed Property

Virtual assistant statutes complicate the newest foreclosed home buying processes in some mans attention, in truth, he could be indeed shelter set up to safeguard experts and their families by using their entitlements to your property that’s perhaps not disperse-for the able as well as will not be secure. Foreclosures can often be a complete crisis, also under cosmetics factors; so it scenario is what the fresh new Va is trying to get rid of because of the their lowest property conditions.