The Resident Economist, with a GradDipEcon as well as five years during the Opes Couples, was a reliable contributor in order to NZ Property Buyer, Told Trader, Content, Company Table, and OneRoof.

It’s great news. You located the right money spent, put on the financial institution for money . plus they said sure.

- what an approval page try

- what parts you need to pay attention so you can, and

- the typical inquiries people always query

- the fresh lending the financial institution try willing to give you

- the eye-only months they are happy to offer

- any conditions he’s for financing you the money. These are generally being forced to get a subscribed valuation otherwise code compliance certification

#1 The thing that makes my personal notice-just loan name shorter than just I imagined it could be?

1) The specific financial will not lend focus-simply for five years. Particularly, particular financial institutions only do-up to 3 age notice-simply, so you might have the longest several months available at that financial.

It means at the conclusion of people five years your loan commonly revert to principal and you will desire automagically. (It claims this in the acceptance letter).

This means https://paydayloansconnecticut.com/noroton-heights/ at the end of that 5 years you really have the entire mortgage waiting for you, the good news is you merely possess 25 years to pay it well.

So, up until the financial approves the focus-just months, they ask . Tend to this borrower be able to pay-off the borrowed funds over 25 many years?

Such as, what if the lending company only acknowledged you for a couple of decades attention-just. Which means they think you might merely manage good twenty-eight-12 months principal and you can appeal loan title.

#2 Exactly why do I want to score an authorized valuation?

That it region is essential: Don’t arrange your own entered valuation. The lending company wouldn’t believe it, and need to pay once again.

After build closes you’re going to get you to definitely same valuer to this new property. They then do a closing certificate (pick second section).

#3 What’s a closing certification? And just why perform I need that?

This course of action uses up to three weeks. It’s always 7 to help you 10 weeks before the valuer can be view the possessions. It might take five days into valuer’s are accountable to break through.

#4 What’s Name? and you may what is actually a password Compliance Certificate?

A password Conformity Certification (CCC) says work suits the building concur. It is a document given because of the council to show your strengthening complies towards the Strengthening Operate.

Brand new term ‘s the judge dysfunction of one’s homes the house or property is on, plus tabs on who owns they (you, just like the the fresh proprietor).

#5 How come I have to offer proof full insurance policies?

There is absolutely no wiggle space to improve they. This means you and your neighbor will use a comparable insurance rates company.

They often think they’re able to buy the insurance carrier because they’re to purchase good tenure identity, but in fact they can’t.

Particularly, you order into the a development with fifty townhouses. For each features its own insurance plan with a special insurance company.

This insurance might possibly be run-through a human anatomy corporate otherwise residents’ connection. That it connection often divvy within the superior and you may charge proprietors to expend the share.

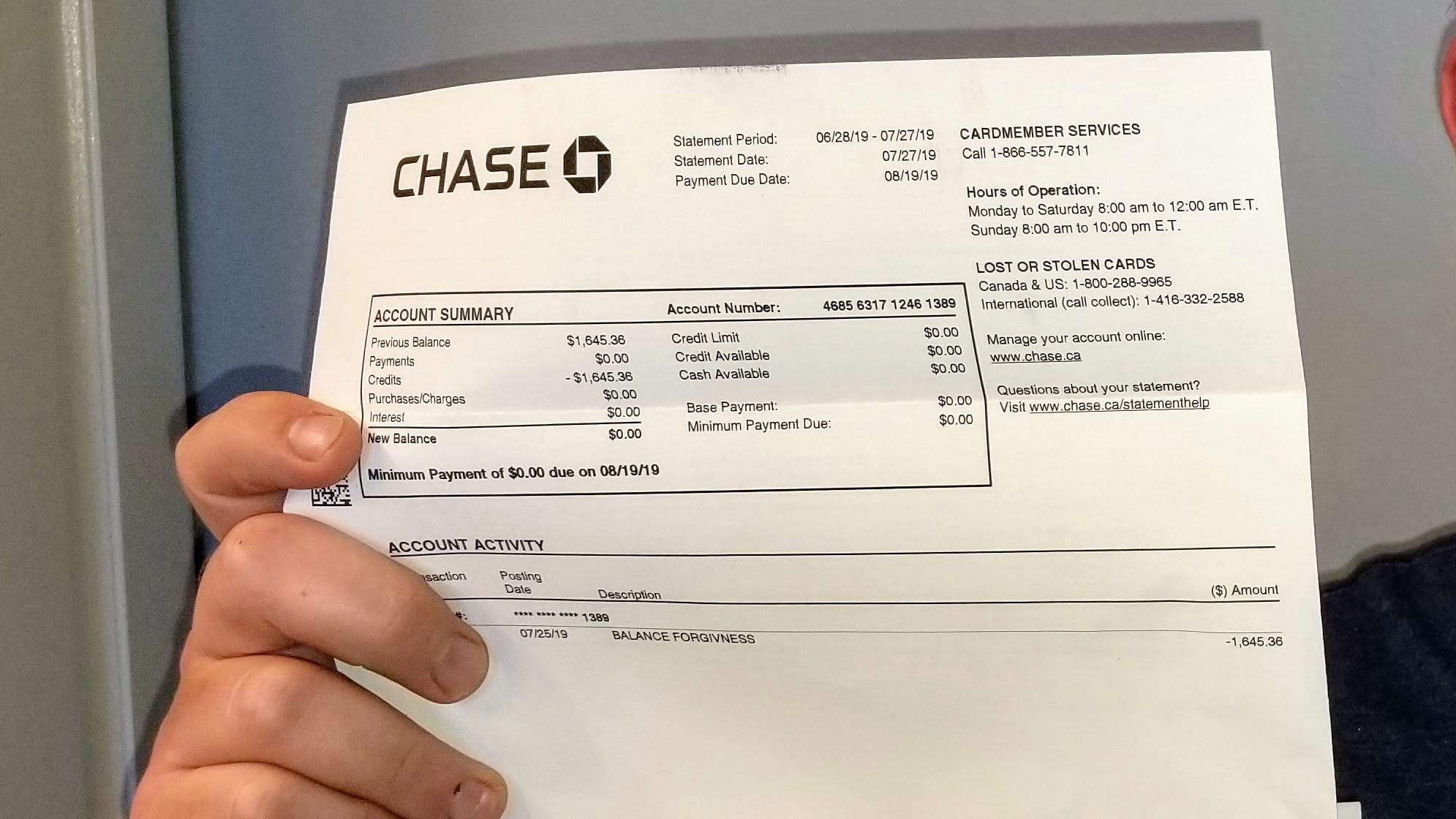

#six Why do I need to romantic my personal credit cards?

An individual charge card could affect exactly how much you could potentially use … although they lives in their bag therefore avoid using they. Why?

For those who have credit cards, a bank commonly evaluate the home loan app as you features currently maxed it.

Very, when you yourself have a beneficial $10,000 limit with the a credit card (even unused), this will cost you around $55k value of borrowing from the bank energy.

#7 The thing that makes the speed

The financial institution can only give cost when you are getting nearer to settlement. This is because there’s a limited amount of time it tend to keep all of them, with out a buyers buying them.

(This is the same to have a profit sum- financial institutions usually do not will often have these types of towards a deal page because the campaigns was subject to transform).

Used, the bank sets it rates on offer so you’re able to teach exactly what the new money could be at this rate. It is not an interest rate bring.

How long does my personal approval history?

Acceptance emails simply continue for an appartment timeframe. Your letter would say the finish day toward front-page.

Or even bring all the info financial institutions want to know to help you until then date you’ll have to initiate the method once more.

April Hastilow

April Hastilow, economic adviser having almost a decade of expertise within the getting lending for over 500 readers, that have the means to access all of the financial during the The Zealand. A home trader by herself, she is excited about greatest formations, multi-financial and you will promoting to have their unique readers using each step of its assets sales. April holds an amount 5 federal certificate within the Home-based credit.