What is actually an enthusiastic 80-10-ten Home loan?

The first financial lien was pulled that have a keen 80% loan-to-really worth (LTV) proportion, meaning that it is 80% of home’s pricing; another home loan lien has good ten% LTV proportion, in addition to borrower helps make a 10% downpayment.

Key Takeaways

- An 80-10-10 home loan is actually prepared which have several mortgages: the initial are a fixed-price mortgage at 80% of your own residence’s prices; next being ten% as a home guarantee mortgage; in addition to remaining ten% since the a funds down payment.

- Such mortgage system reduces the deposit off a good house without paying individual mortgage insurance policies (PMI), enabling consumers receive a loan places Rock Mills home quicker to your up-side costs.

- However, consumers have a tendency to face relatively big month-to-month mortgage repayments and may look for large payments owed with the varying loan when the rates of interest boost.

Skills an enthusiastic 80-10-10 Home loan

???????Whenever a potential resident purchases a house with lower than the brand new fundamental 20% down payment, he’s necessary to shell out private home loan insurance policies (PMI). PMI are insurance you to definitely covers the bank financing the money up against the likelihood of this new debtor defaulting towards the a loan. An 80-10-10 home loan can be employed by consumers to avoid using PMI, that will generate an effective homeowner’s payment per month large.

As a whole, 80-10-ten mortgages are preferred on occasion whenever home values try accelerating. Because the belongings feel reduced sensible, while making a great 20% downpayment of money will be difficult for one. Piggyback mortgages create consumers so you can use additional money than just the down fee you will highly recommend.

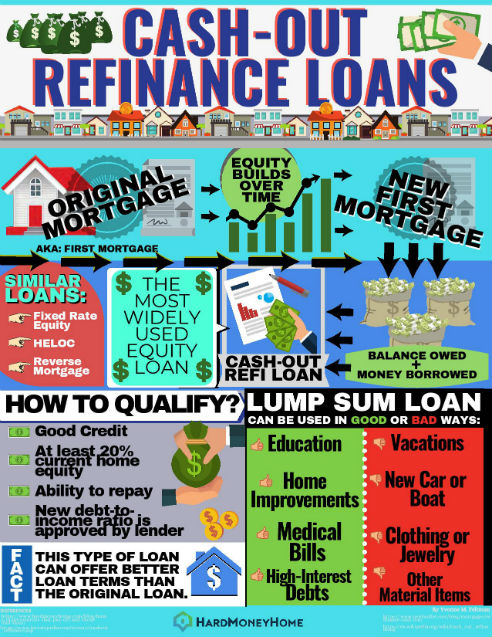

The original home loan of an 80-10-10 home loan is often always a predetermined-rate mortgage. The next mortgage is usually a varying-speed home loan, such as for example property equity mortgage otherwise house collateral collection of credit (HELOC).

Benefits of an enthusiastic 80-10-10 Financial

Next financial properties such as for instance a credit card, but with a lower interest rate given that security on the domestic will straight back they. As such, they just incurs interest if you use they. Consequently you could potentially pay back the home guarantee mortgage otherwise HELOC entirely or perhaps in part and you may dump desire money to the that money. More over, once settled, the newest HELOC stays. Which personal line of credit can try to be an urgent situation pond some other costs, such as for example household renovations otherwise education.

An enthusiastic 80-10-ten loan is an excellent choice for folks who are trying to to find property but i have not yet sold the present household. In this condition, they would use the HELOC to fund an element of the downpayment toward brand new home. They would pay off brand new HELOC in the event that old house deal.

HELOC interest rates is more than those people to own old-fashioned mortgages, that will a bit counterbalance the savings achieved by having an enthusiastic 80% financial. If you intend to pay off new HELOC in this a number of age, this may not be problems.

When home values are rising, the security increase together with your residence’s worth. But in a housing market downturn, you might be leftover dangerously underwater which have a property that’s worthy of lower than you owe.

Exemplory instance of an 80-10-10 Mortgage

The fresh Doe loved ones desires buy a property to have $300,000, and they’ve got an advance payment out of $29,000, which is ten% of the full house’s worth. Having a normal 90% mortgage, might have to pay PMI in addition monthly mortgage repayments. Together with, a good 90% home loan will generally bring a high rate of interest.

Alternatively, brand new Doe nearest and dearest may take away a keen 80% home loan to possess $240,000, possibly from the a lowered interest rate, and avoid the necessity for PMI. Meanwhile, they will take out one minute ten% home loan out of $29,000. This probably would-be a good HELOC. The latest advance payment will still be 10%, nevertheless household members will stop PMI will cost you, get a better interest rate, and thus keeps straight down monthly obligations.