Refinancing may also possess a negative affect a great borrower’s borrowing get. Every time a borrower applies for a financial loan, they contributes to a difficult query to their credit history. Numerous questions normally down a good borrower’s credit history, it is therefore harder so you’re able to qualify for funds down the road.

When mortgage refinancing, individuals is generally susceptible to dropping equity within their home. This will occurs in the event the debtor removes an alternate mortgage that’s bigger than the first financial, as well as the borrower struggles to make costs. In such a case, the lender will get foreclose with the possessions, as well as the borrower you will definitely remove their house.

If you are refinancing can help down rates of interest, additionally, it may end in high pricing in the event your debtor features bad credit or if rates of interest features risen because the unique financing are applied for. This may result in large monthly installments and you can full will cost you more than living of the financing.

Full, while refinancing funds can be an attractive option for consumers looking to minimize monthly payments and lower interest rates, there are even several high cons to consider. Consumers would be to cautiously weigh these factors before carefully deciding and believe each of their possibilities, and discussing with the newest bank otherwise seeking other designs off debt settlement.

As the a debtor having a varying-price financing, you’re wondering when may be the best time and energy to envision refinancing. Refinancing the loan will save you profit this new much time work on, particularly when you will be expecting the interest to increase. Although not, it is critical to weigh the benefits and disadvantages of refinancing before making a choice. On lender’s position, a debtor whom refinances the financing usually , making the lender missing out. Since the a debtor, you want to make sure that you are making an informed financial choice for the problem, whilst because of the impact on the financial institution.

1. Measure the markets trends: Keep a close eyes on the market fashion and the movements of one’s COFI index. Should your index begins to increase continuously, there can be a good chance one rates of interest will abide by match. $500 loan in Inverness When you’re concerned with their rate of interest broadening, refinancing in order to a fixed-rates loan might be recommended.

2. Assess the price of refinancing: Refinancing that loan come with can cost you such as for instance application costs and settlement costs. Be sure to comprehend the costs of this refinancing and you will calculate if the possible discounts justify the expense.

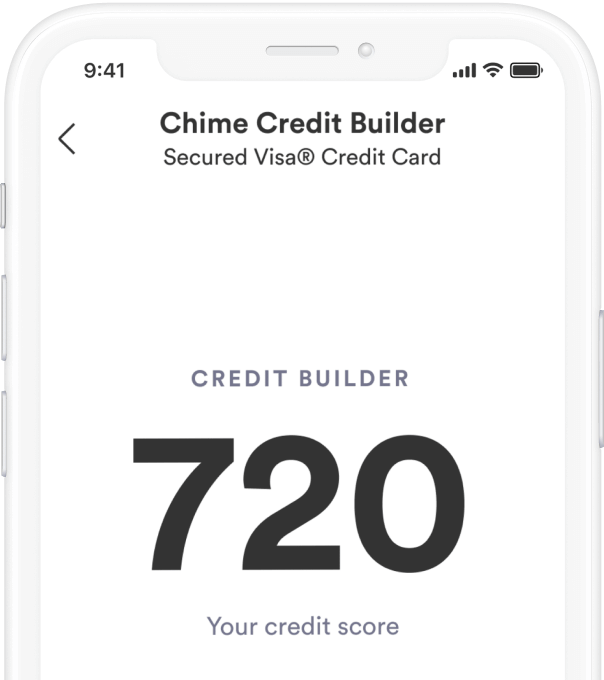

step three. Test thoroughly your credit history: Your credit rating performs a vital role regarding rate of interest you may be given. In case your credit score enjoys increased since you first took away the mortgage, you will be offered a reduced interest rate whenever refinancing. This might produce extreme discounts over the longevity of this new mortgage.

cuatro. When you’re nearing the conclusion the loan name, may possibly not be worth it so you can refinance as your notice speed will have a shorter time to fluctuate. Although not, when you have an extended-identity financing, refinancing might be an intelligent disperse.

Look at the duration of the loan: The length of the loan may feeling if or not refinancing try a great choice

In a nutshell, refinancing a changeable-rate loan is a good clear idea in the event the market trend imply an increase in rates, if your credit history possess increased, and if the expenses off refinancing try rationalized from the prospective offers. But not, you will need to meticulously have a look at your personal situation as well as the effect with the financial prior to making a final decision.

6.Refinancing The loan [Modern Blog]

Refinancing your loan are a strategy that will help cut profit the future. It requires taking right out an alternative financing to settle the existing mortgage, usually with an increase of favorable conditions. There are lots of reason why anyone may want to refinance their mortgage, along with reducing monthly installments, decreasing the interest rate, and you will modifying the borrowed funds term. not, it is vital to note that refinancing is not always the best selection for someone, possible come with its band of charge and you may official certification.

![5.When to Consider Refinancing Their Varying-Rates Financing? [Amazing Weblog]](https://12game.shop/wp-content/themes/rehub-theme/images/default/noimage_70_70.png)